Uncle Sam's Section 179 Tax Deduction for 2013

It's that time of year again...figuring out how to keep more of your money for your business. Our friends at Tech Financial sent us the latest information on this year's Section 179 Federal Income Tax Deduction...it's not as great as the 2011 Section 179, but it's still money in your pocket. REMEMBER, we are not accountants so please check with your accountant to confirm eligibility for tax benefits.

Overview of Section 179 Deduction for 2013

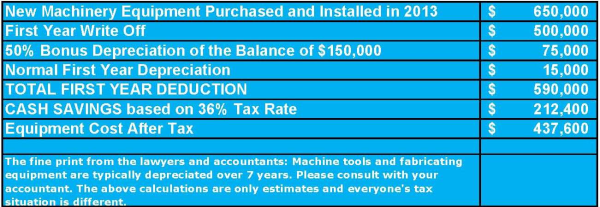

- You can deduct $500,000 when you purchase up to $2 million in equipment (it phases out between $2 million and $2.5 million).

- You also can take a special 50% Bonus Depreciation for NEW equipment placed in service during 2013. This deduction allows an additional 50% first-year depreciation on the adjusted basis of qualified new equipment.

Here is an example from Tech Financial Services.

You can plug-in your own numbers with the interactive worksheet Tech Financial Services created. Just click on the Download Worksheet button below.